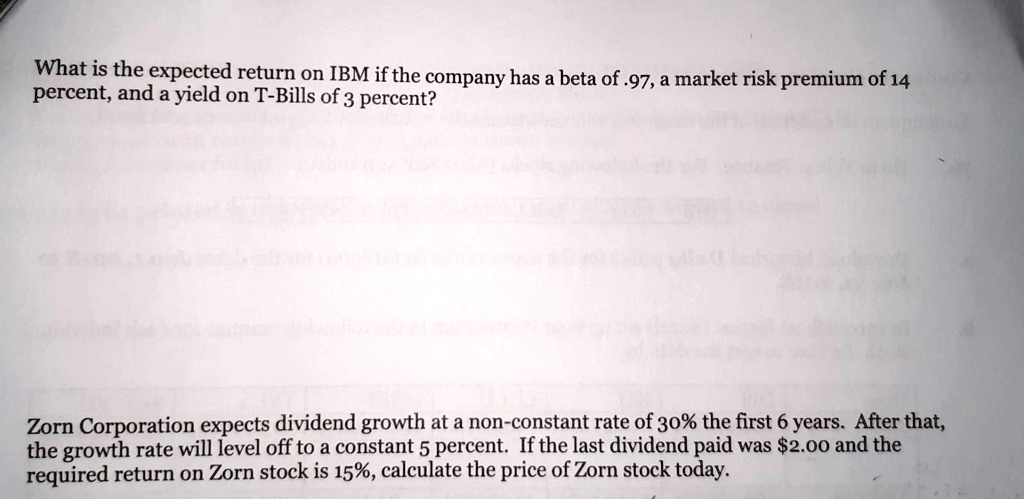

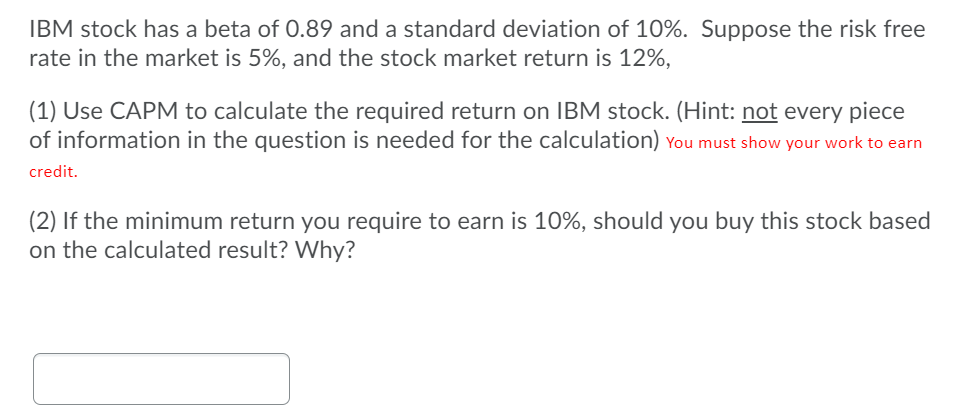

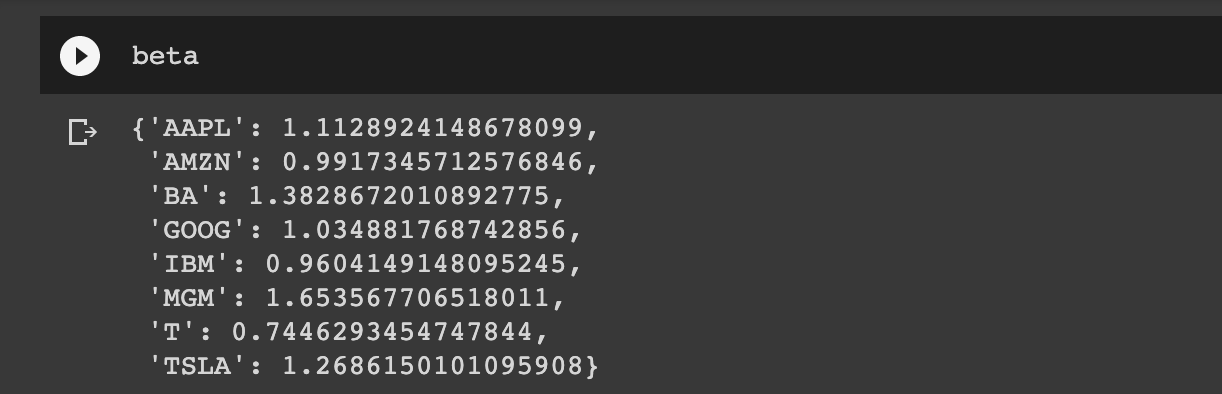

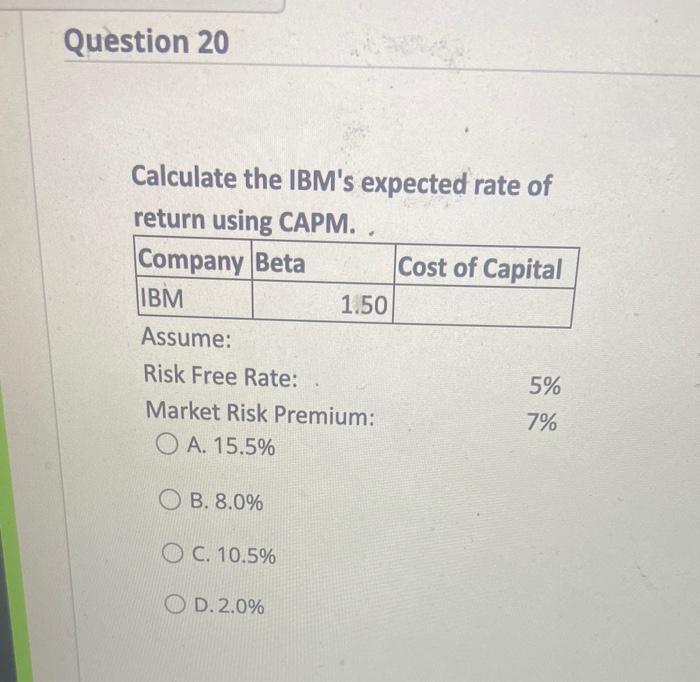

SOLVED: What is the expected return on IBM if the company has a beta of .97, a market risk premium of 14 percent,and a yield on T-Bills of 3 percent? Zorn Corporation

4 and a half myths about beta in finance | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics

![Solved] Suppose that the Treasury bill rate is 9% | SolutionInn Solved] Suppose that the Treasury bill rate is 9% | SolutionInn](https://s3.amazonaws.com/si.experts.images/questions/2021/03/603f7df28ecff_1614773745250.jpg)